Is Your Benefits Package Built for the Future of Work?

In an era of “Quiet Quitting” and the war for talent, standard medical insurance and a stocked pantry are no longer enough. Today’s workforce looks for more than a paycheck—they look for financial security and a partner in their long-term wellbeing.

By integrating Private Retirement Scheme (PRS) contributions into your benefits package, you aren’t just helping employees save; you are positioning your organization as an Employer of Choice. Show your workforce that you are invested in their long-term welfare from Day 1 to retirement. Stand out as a caring employer while helping your team bridge the retirement gap that mandatory savings alone cannot fill.

When We, Empowered via PRS

made by Employers

Example

Kreatif Sdn Bhd made the following contributions for the accounting period ending on 31 December 2020:

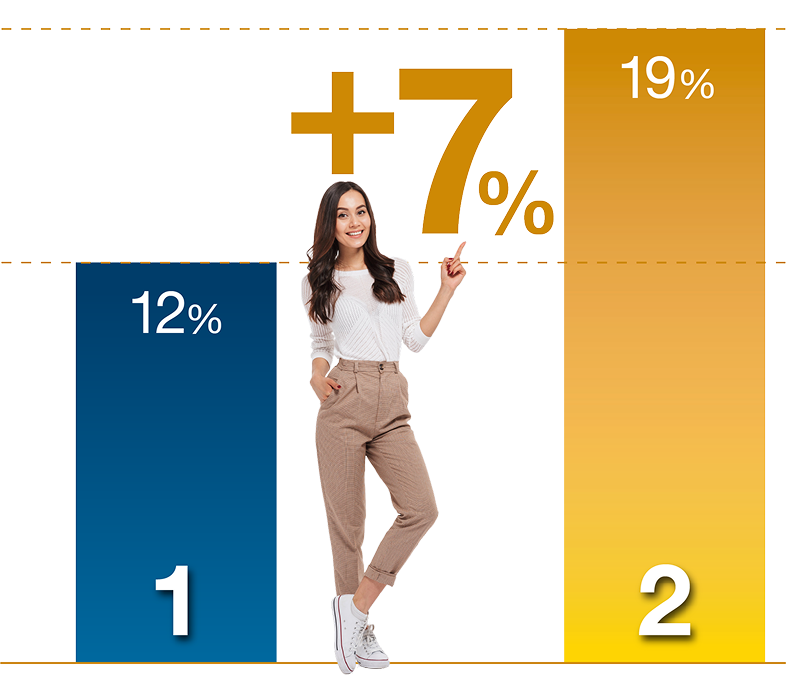

(a) EPF = 12% of employees’ remuneration and

(b) PRS funds = 7% of employees’ remuneration

Total employees remuneration for the period was RM300,000. Allowable deduction to the company under subsection 34(4) of the Income Tax Act is RM57,000 (RM300,000 x 19%).

Source: Inland Revenue Board (Private Retirement Scheme – Public Ruling No. 9/2014 Section 5.2).

Ways To Start Contributing In PRS

Employers can introduce PRS to employees and encourage saving more for retirement by implementing:

PRS can be implemented as part of the corporation’s benefit and compensation package, whereby employers can make contributions on the employees’ behalf to a PRS fund of their choice. Employers can sponsor the adoption of the PRS via:

- Employee Service & Milestone Awards to reward loyal employees for their long-term service.

- Employee Performance Awards to celebrate high-performing employees for their achievements.

- Employee Bonus Schemes to reward employees with cash, PRS contributions or both.

Employers can match the employees’ PRS contributions as an incentive for employees to continue saving in PRS for retirement. The minimum and maximum contribution amount can be determined by the employer.

Employers can offer a payroll deduction facility for employees to save in PRS every month from their salary on top of their mandatory contributions. Employees can determine which PRS fund(s) to save and the amount to be deducted from their salary every month.

The automation of PRS contributions monthly inculcates an unconscious habit of saving amongst employees.

For further information about the Department of Labour’s application procedures to implement salary deduction, employers may visit:

- For Peninsular Malaysia: http://jtksm.mohr.gov.my

- For Sabah: http://jtksbh.mohr.gov.my

- For Sarawak: https://www.jtkswk.gov.my

YES!

How Do We, Empower via PRS

If your corporation wants to learn more about PRS funds or the offerings of PRS Providers, PPA, as the central administrator for PRS, can arrange meetings with your preferred PRS Provider(s) for further discussions.

To schedule an online PRS Presentation for your employees, contact PPA by filling out the form below.

TAKE THE FIRST STEP TODAY

INVEST IN YOUR EMPLOYEES FUTURE:

WE, EMPOWER VIA PRS