Make Time and Compound Growth Work for You

PRS is a long-term savings and investment scheme designed for your retirement. When it comes to your retirement savings, the element of compounding is a powerful tool as it essentially means interest or earnings are added to your contributions over your period of investing until retirement. Give your PRS contributions time to grow and tap on the power of compounding on your contribution amount.

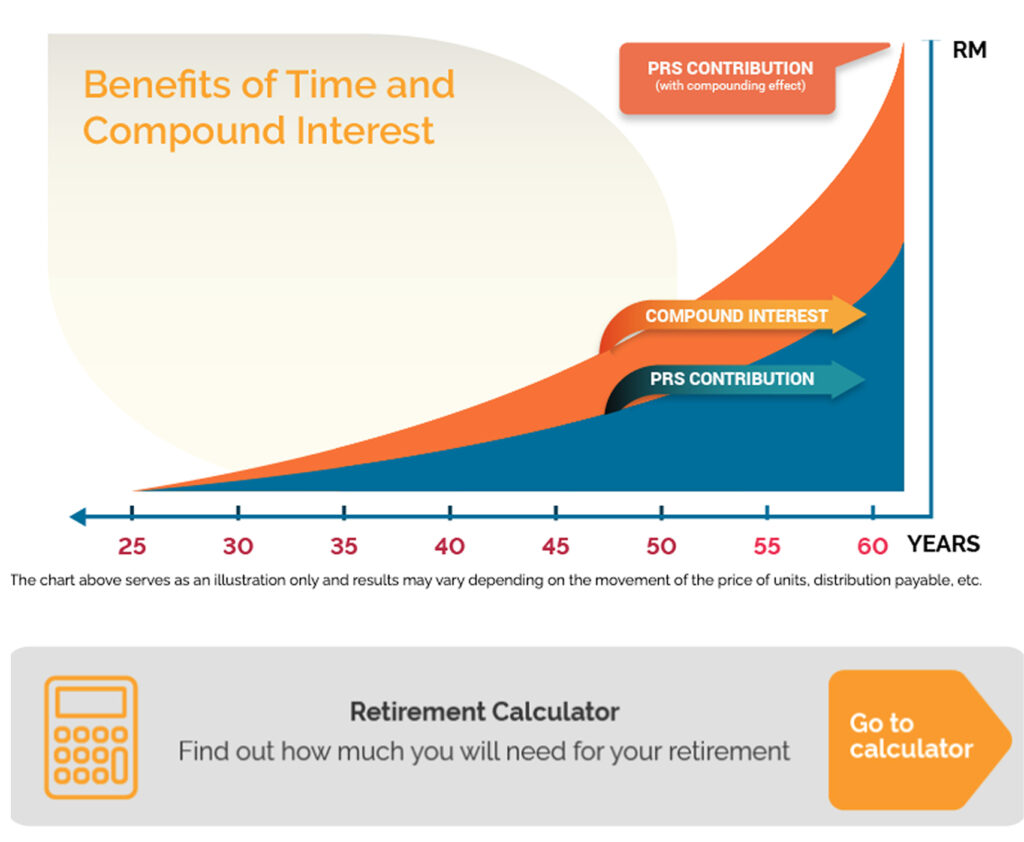

For a simple illustration on how compound interest works on your PRS contribution, see the chart below:

Saving More with PRS is a Big Plus for Your Retirement

Increasing your PRS contributions will enhance the growth of your retirement funds by harnessing the power of compounding on your contributions overtime. The bigger your retirement funds, the better funding you will have for your retirement needs. No matter your stage in life, you can always save more for a better retirement.

Compound Growth 101

“Start early. I started building this little snowball at the top of a very long hill.” – Warren Buffet

Increasing your PRS contributions will enhance the growth of your retirement funds by harnessing the power of compounding on your contributions overtime. The bigger your retirement funds, the better funding you will have for your retirement needs. No matter your stage in life, you can always save more for a better retirement.

Compound growth is when the return on your saving is reinvested for future growth in a long term saving scheme such as PRS.

Even Small Amounts Add Up

With compounding, even small amounts can add up over time. For instance, if you put RM25 a week in a jar for 30 years, you’d get RM39,000. But if you invest it instead, here’s how much it can potentially grow.

The Snowball Effect

Think of compound growth as rolling a snowball down a hill. As your savings roll down the hill, it gradually gets bigger when it reaches the bottom. The key is to have a very long hill and build the snowball by starting younger or saving longer.

Let us look at the case of two colleagues, Maria and Jeff.

At age 60, Maria has larger savings because she started saving early, despite lower monthly contributions.

| Maria | Jeff | |

|---|---|---|

| Age | 25 | 35 |

| Monthly contribution (RM) | 100 | 200 |

| Total contribution up to 60 years old (RM) | 42,000 | 60,000 |

| Estimated PRS savings at 60 years old (RM) | 142,471 | 138,599 |

Note: Assuming no change in contribution amounts over the years and a steady 6% return per year.