Regulatory Framework

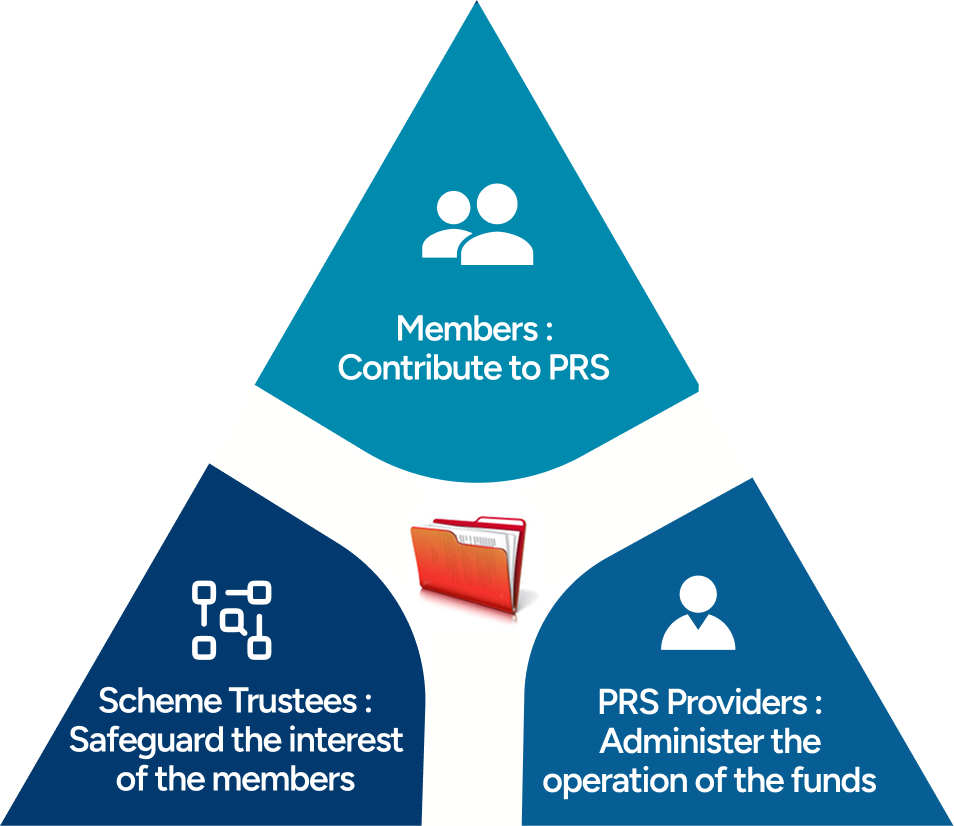

The PRS regulatory framework is established under the Capital Markets and Services Act (CMSA) 2007 and is regulated and supervised by the Securities Commission Malaysia (SC) to ensure robust regulation and supervision of the PRS industry whilst promoting trust and confidence in the PRS. There is a proper segregation of roles and responsibilities of all key parties in the PRS industry as follows:

Key Components

Suruhanjaya Sekuriti

(Securities Commission Malaysia)

Regulates the PRS industry under the Capital Markets & Services Act 2007 (CMSA). Provides a regulatory environment and promotes the development of the PRS industry.

Roles & Responsibilities

Scheme Trustees

Each PRS scheme is required to appoint an approved PRS scheme trustee to actively monitor the operation and management of the fund under the scheme by the PRS Provider to safeguard the interests of members. The scheme trustees has a fiduciary duty to ensure that the PRS Provider comply with the scheme’s deed and disclosure document. In addition, the PRS scheme trustee provides custodianship of the PRS fund’s assets.

Trust Deed

A legal documentation that sets the obligation of the Scheme Trustee and the PRS Providers as well as the rights of the members.

Disclosure Document

A document that is intended to provide to PRS subscribers the key characteristics of the fund, obligations of the Provider, risks profile and essential elements of the fund.