What Are The 3 Retirement Concerns I Should Know About?

Retirement varies for everyone, but it boils down to three key factors:

- having enough money to maintain your lifestyle,

- making your savings last, and

- planning for inflation.

1. Adequecy

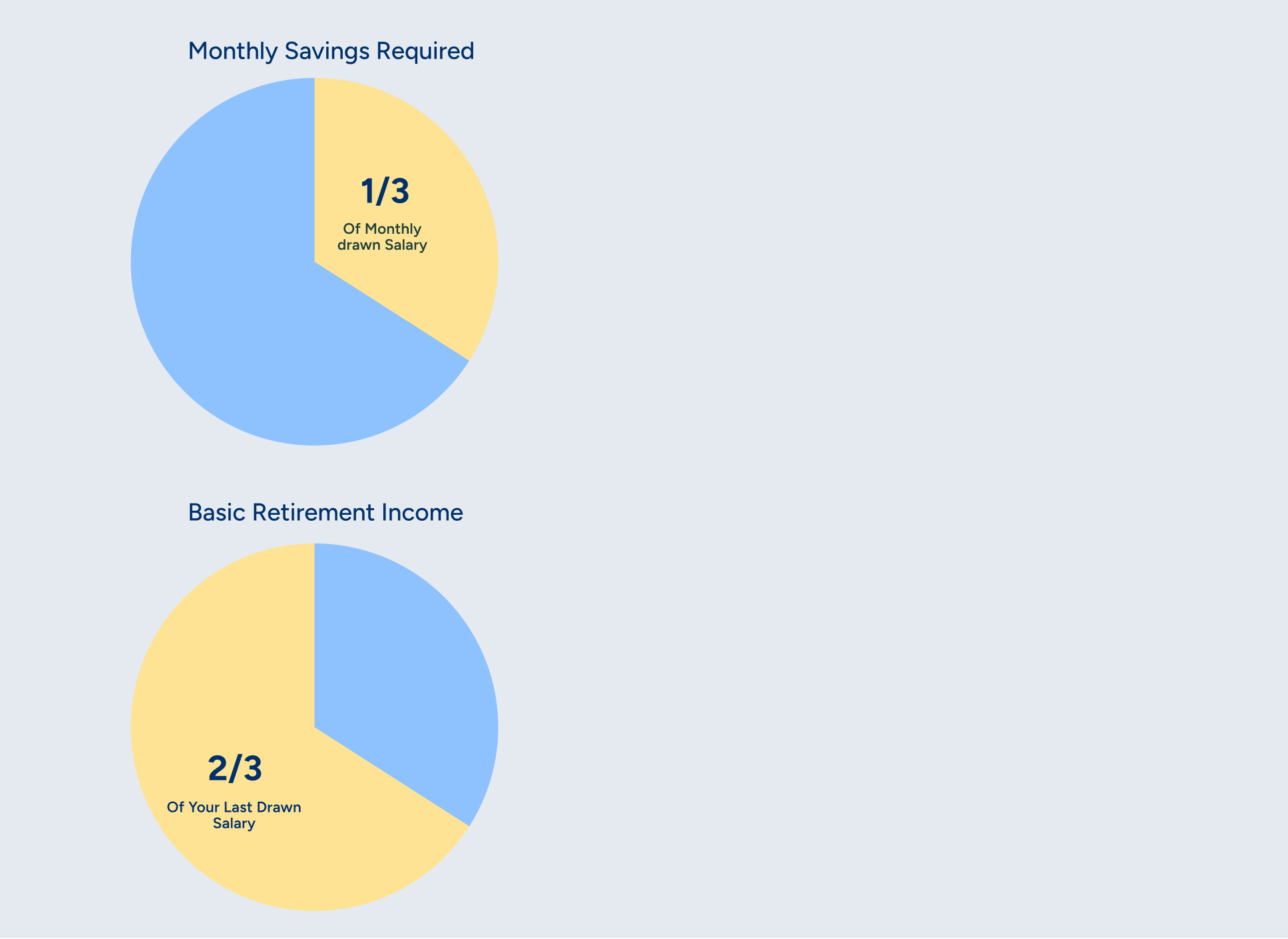

It is recommended that you save 1/3 of your monthly salary now to have 2/3 replacement income when you retire.

2. Sufficiency

As life expectancy rises, make sure your savings last. Stay financially independent.

3. Sustainability

Maintaining your standard of living now will cost you more in the future.

1. Adequecy

An adequate income replacement ensures you can maintain your standard of living without drastically reducing your expenses.

2. Sufficiency

The life expectancy of Malaysians is increasing, with Male expected to live until 73 years and Female until 77.8 years (Department of Statistics Malaysia, 2024). You’ll need sufficient replacement income to last at least 20 years.

3. Sustainability

Inflation raises your cost of living and reduces your purchasing power. Over time, your savings will buy less, so it’s crucial to account for inflation in your retirement planning to ensure you have enough to maintain your lifestyle.